Can landlords, mortgage providers and tenants work together to serve everyone’s best interests?

Stephen Wright, Business Development Manager at TSB, gives some insight into the ever-changing rental market and how our concessionary purchase option could be the answer for landlords looking to sell their properties to their tenants with no deposit required.

If only I had a pound for every time I’ve heard a story from a tenant about their rent increasing and how this is going to leave them significantly worse off than before.

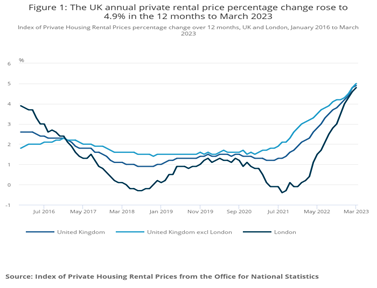

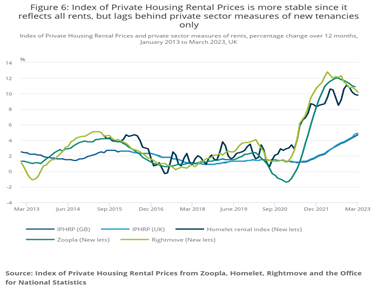

According to the ONS, UK private rent increased by 4.9% in the 12 months to March 2023.

However, if we go into detail the story is much more concerning. Rightmove records over a 10% increase in private rent prices in the 12 months to March 2023.i The two figures contrast because Rightmove is recording new tenancy agreements rather than a combination of all.

We can interpret this contrast with our experiences of the current market. Landlords are increasing rental costs for new tenants that then fits within the market rate for rent costs but are protecting existing tenants as much as they can. As more landlords exit their fixed rate deals and suffer the higher costs associated with this, then the first figure may increase.

Tenants often put these increases in rent due to landlords looking to squeeze as much cash out of them as possible and believe that they are making egregious profits.

Landlords however have a very different take on the situation. Following regulatory changes (past, present and future), tax changes and mortgage payment increases, they are finding themselves less profitable than ever. According to Money Week, the average Buy to Let mortgage rate on the 20 June was 6.4%. This has led to a decrease in profits from 23% (2014-2021) to just 4% in 2023 for landlords with more challenges to come.ii

Just as the tenant blames the landlord, the landlord often blames the government or mortgage lender who in turn cite the money markets, BOE and persistent inflation. The list goes on.

The fact of the matter is, tenants don’t want to see their rent costs increase, landlords don’t want to see their profit margin reduce and lenders don’t want to see pain and suffering caused to people due to rate increases.

The past, present and future changes in the Buy to Let market have clearly, as displayed in the data above, reduced profitability and I believe this is where we need to change the narrative when discussing a landlord’s options when they approach the end of their fixed rate deal or when they are looking for advice.

The conversation needs to move away from the traditional, lets seek out the best rate, towards a bigger picture question. Are you making a profit now and will you be making a profit that is worth your time and energy in the future?

TSB are well placed to help break this negative cycle and facilitate tenants, landlords and lenders to work together to serve everyone’s best interests.

If you are a landlord and sell your property to your tenant with a 10% discount or more, the tenant doesn’t need a single penny towards their deposit. Using our concessionary purchase option can help tenants and often the First Time Buyers who are hardest hit due to paying higher rent costs and having little opportunity to build their deposit to buy their first home. The landlord can take the capital growth and use it to re-gear other properties they own or invest elsewhere, and TSB can help by facilitating the transaction and supporting those tenants onto the housing ladder.

Our Mortgage Distribution Director, Roland McCormack also gives us some further benefits to why a concessionary purchase may be the right route for all parties involved.

‘This can be a great option for the buyer as they get a discount, but also because they know the area and the property well already.

For the seller, it makes the process easier and smoother. They don’t have to have a tenant move out of the property, do it all up, and then wait several months – all while not receiving rent.

The seller and the buyer also avoid paying fees that would normally be involved with a house sale – such as estate agent fees.’

Roland McCormack – Mortgage Distribution Director

TSB

This is how we can break this negative cycle and look to start supporting one another to gain money confidence. Find out more on our Concessionary Purchase page.

i Index of Private Housing Rental Prices, UK - Office for National Statistics (ons.gov.uk)

ii Is it time to give up on buy-to-let? | MoneyWeek

Stephen Wright

Business Development Manager

TSB Mortgage Intermediaries